In this form you will be able to. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Malaysia Accounting Software Best Accounting Software Accounting Software Accounting

Verify your PCBMTD amount 5.

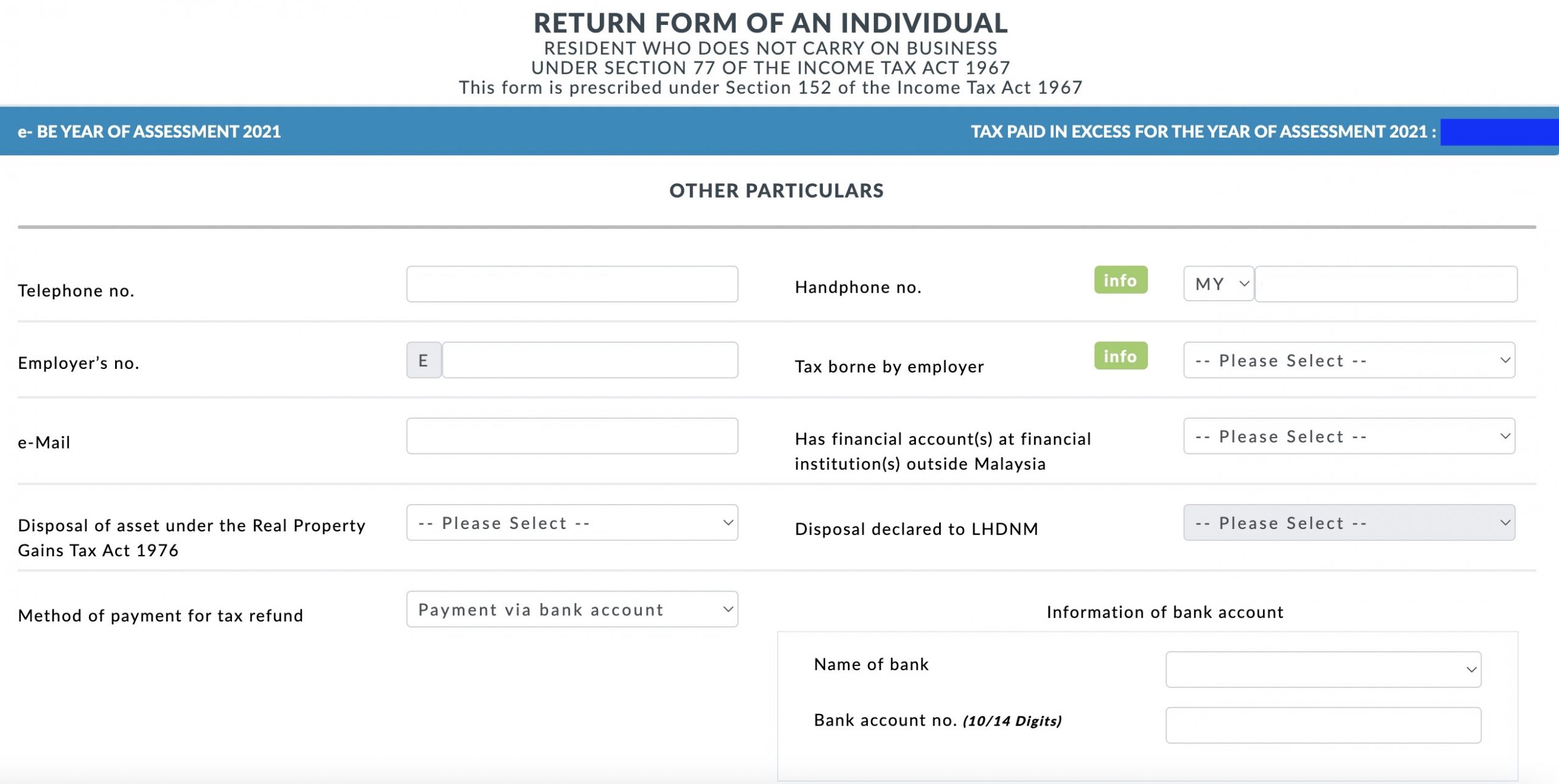

. On the other way round. For the BE form resident individuals who do not carry on business the deadline falls on. Meanwhile if you did not register your business then use the usual BE form for those with non-business income to file your tax as a freelancer instead.

After registering LHDN will email you with your income tax number within 3 working days. Foreigners who stay and work in Malaysia for more than 182 days are subject to tax and they must file and pay their tax to the Inland Revenue Board of Malaysia. First is to determine if you are eligible as a taxpayer 2.

This is a 2 part series on HOW TO FILE INCOME TAX in Malaysia. The employment income receivable in the following year whether received or not on an individual who has left of will be leaving Malaysia in which he is a non-resident in the following year will be taxed in the year he leaves Malaysia permanently as provided under subsection 25 6 of the ITA. Save your Tax Reference number.

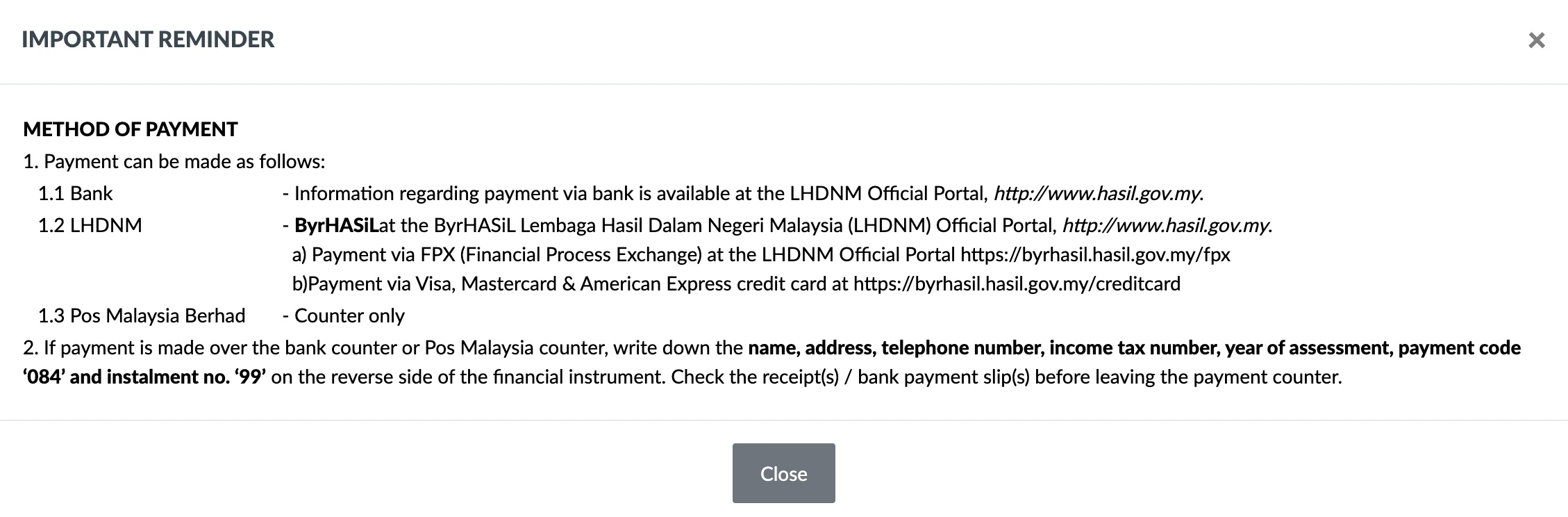

Failure to do so can result in a 10. Monthly Tax Deduction MTD Aside from that the Monthly Tax Deduction MTD also known as PCB programme also makes for a slightly different filing process between an employed. Once you have double-checked your details click Accept.

Real Property Gains Tax RPGT Rates. If the IRS website cannot find your PIN then you can call the IRS to get a new PIN issued. In your own time zone.

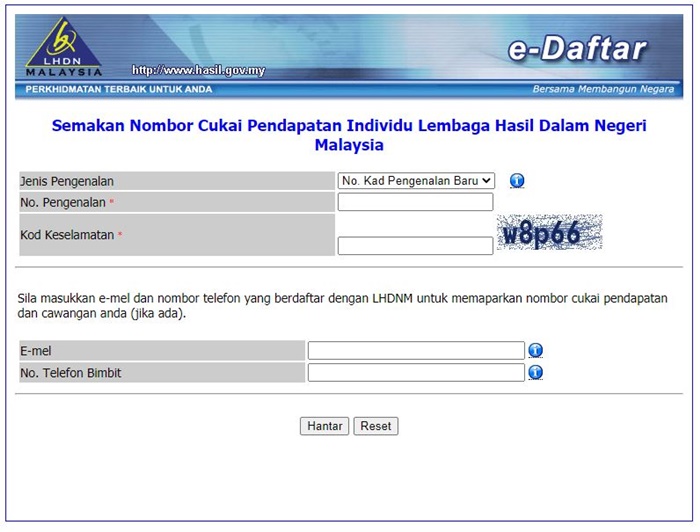

How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time. Ensure you have your latest EA form with you 3. Alternatively you can either check online via e-Daftar or give LHDN a call at 03-89133800.

The first part is about the preparation and things you SHOULD know before filing your tax retu. Click on Permohonan or Application depending on your chosen language. They need to apply for registration of a tax file.

File your income tax online via e-Filing 4. Click on e-Filing PIN Number Application on the left and then click on Form CP55D. You must be wondering how to start filing income tax for the.

Non-resident stays in Malaysia for less than 182 days and is employed for at least 60 days in a calendar year. Where a company commenced operations. All tax residents subject to taxation need to file a tax return before April 30th the following year.

You can call 800-908-4490 Monday through Friday from 700 am. Introduction And Basis Of Taxation. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

IRBM Revenue Service Centre Operating Hours. Maximising your tax relief. Registration of companys tax file is the responsibility of the individual who managing and operating the company.

The tax year in Malaysia runs from January 1st to December 31st. Foreigners who qualify as tax-residents follow the same tax guidelines. IRBM Stamp Duty Counter Operating Hours.

For the BE form resident individuals who do not carry on business the deadline for. You can save the page as a PDF by. Record down your tax reference number.

Tax Transaction Listing Web Based Online Accounting Software Malaysia Online Accounting So Online Accounting Software Accounting Software Online Accounting

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Guide To Using Lhdn E Filing To File Your Income Tax

Guide To Using Lhdn E Filing To File Your Income Tax

P Cecilia I Will Provide Accounting And Tax Services Malaysia For 190 On Fiverr Com Accounting Services Tax Services Bookkeeping Services

Guide To Using Lhdn E Filing To File Your Income Tax

T Glide Files How To Retrieve And Insert Filing System Accounting Office Office Filing System

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Orisoft Is The More Famous Software Company In Malaysia To Get These Services Easily Like Human Resource Software Hr Management Payroll Software Management

Trademark Registration Procedure Includes Trademark Search And Trademark Application Filing Lea Trademark Registration Trademark Search Marketing Services

7 Tips To File Malaysian Income Tax For Beginners

How To File Your Taxes For The First Time

Yc Backed Cleartax Embarks Upon India S Fast Growing Online Tax Filing Market Http Tropicalpost Com Yc Backed Cleartax Emb Filing Taxes Online Taxes Start Up

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau